Getting paid for legal services can be a uniquely difficult process for immigration lawyers. Between limited payment options, manual invoicing, and clients struggling to cover large upfront costs, managing payments can often feel like more work than it should be. Plus, the financial strain that comes with the immigration process makes it difficult for many clients to pay in full right away—and when payments are delayed, it can disrupt cash flow for the firm and create stress.

That’s where offering flexible immigration lawyer payment plans can make a difference. Payment plans give clients a more manageable way to afford high-quality legal representation while also helping firms maintain steady, predictable revenue. In this article, we’ll break down the most common payment challenges immigration lawyers face, explore the benefits of offering payment plans, and outline how to set them up effectively to make getting paid easier for both you and your clients.

How Do Immigration Lawyers Typically Get Paid?

Not all practice areas run their finances the same—so how do immigration lawyers get paid? Usually, they are paid through upfront retainers, flat fees, or hourly billing. While these methods are straightforward, large retainers can be difficult for clients to pay upfront, and hourly billing often makes it hard for clients to anticipate total costs. This uncertainty can lead to delayed payments, missed invoices, and inconsistent cash flow—all of which can disrupt a firm’s financial health.

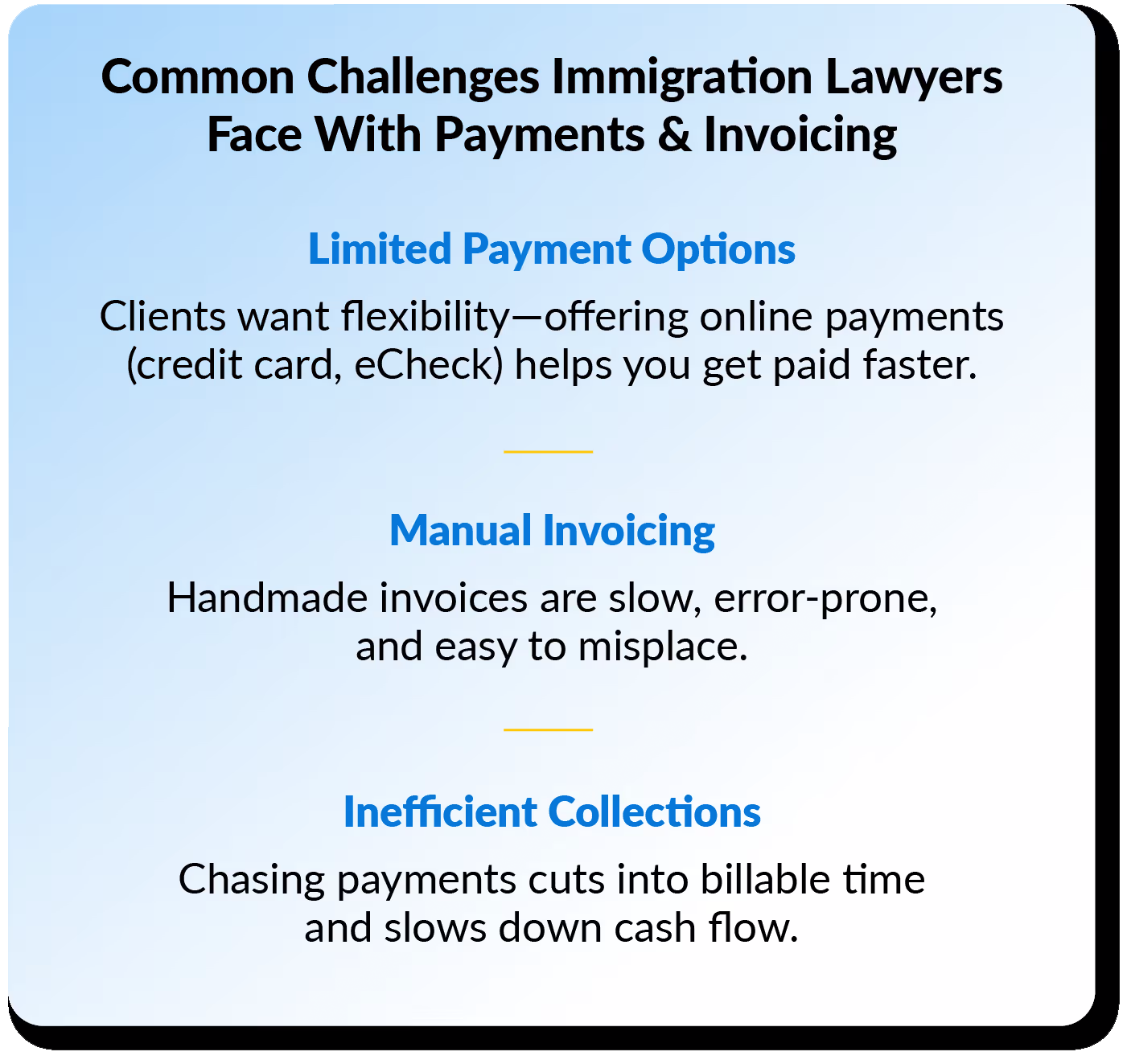

Common Challenges Immigration Lawyers Face With Payments & Invoicing

Understanding the challenges listed below is the first step toward finding a solution that works for both you and your clients.

Limited Payment Options

Immigration lawyers often face a lack of convenient and flexible payment options. Offering secure online payment solutions—including credit card and eCheck options—gives clients the flexibility to pay how and when they want, which helps firms get paid faster and more consistently. Additionally, secure, online payments that are paired with Interest on Lawyers’ Trust Accounts (IOLTA) compliant solutions ensure that payments are processed correctly and meet legal trust accounting standards.

Manual Invoicing

Creating and sending invoices manually is time-consuming and prone to human error. Lawyers often need to track billable hours, expenses, and client details across multiple cases, and when done manually, mistakes are easy to make. For instance, a missed decimal point, incorrect date, or forgotten charge can create confusion, delay payments, and even undermine trust with clients. Additionally, manual invoices can get lost in the shuffle of emails or paperwork—making it harder to follow up and collect payments on time.

Legal billing software, such as Docketwise, allows immigration lawyers to automate the invoicing process—reducing errors and ensuring that clients receive clear, accurate bills.

Inefficient Collections

Paper-heavy processes, excessive email chains, and redundant data entry aren’t just frustrating—they’re expensive. Time lost searching for documents or tracking down payments cuts into billable hours. Plus, inaccurate timekeeping can lead to underbilling, missed revenue, or overbilling, which erodes client trust.

Automated payment solutions—like recurring billing and payment reminders—streamline collections, reduce human error, and improve cash flow consistency. By offering flexible online payment options and automating reminders, firms can minimize missed payments and ensure a smoother, more reliable collection process.

The Benefits of Payment Plans for Immigration Lawyers and Clients

Offering lawyers payment plans creates a win-win situation for both immigration lawyers and their clients. Let’s go over some of the top benefits.

Affordable Access to Legal Representation

Immigration cases are often expensive and require ongoing legal support over several months or even years in some instances. For many clients, coming up with a large lump sum upfront is not feasible—especially when they are already facing financial challenges related to their immigration status, relocation costs, and legal fees.

Payment plans allow clients to access the legal support they need without facing overwhelming financial pressure. Instead of needing to pay a large retainer or flat fee all at once, it’s often more manageable for clients to break payments up into monthly or bi-weekly installments. This not only makes it easier for clients to budget for legal expenses but also reduces the risk of delays in filing applications or missing critical deadlines due to lack of funds. Flexible payment plans also help ensure that financial barriers don’t prevent clients from securing high-quality legal representation when they need it most.

Improves Cash Flow for Law Firms

Immigration lawyer payment plans provide a steady, predictable revenue stream by allowing firms to collect payments on a recurring basis. Additionally, automated billing and reminders reduce the chances of late or missed payments—ensuring that the firm gets paid consistently and on time.

As a result, firms maintain financial stability, cover overhead costs, and are free to focus their efforts on providing excellent legal services rather than worrying about cash flow gaps.

Enhances Client Satisfaction and Retention

When it comes to lawyer payments, clients value convenience and transparency. Offering structured payment plans—combined with secure online payment options—creates a smoother client experience and builds trust between the client and the firm.

Additionally, offering flexible payment options makes clients feel supported and understood, which strengthens the lawyer-client relationship. Satisfied clients are more likely to return for future legal services and refer others to the firm—driving long-term growth and improving client retention.

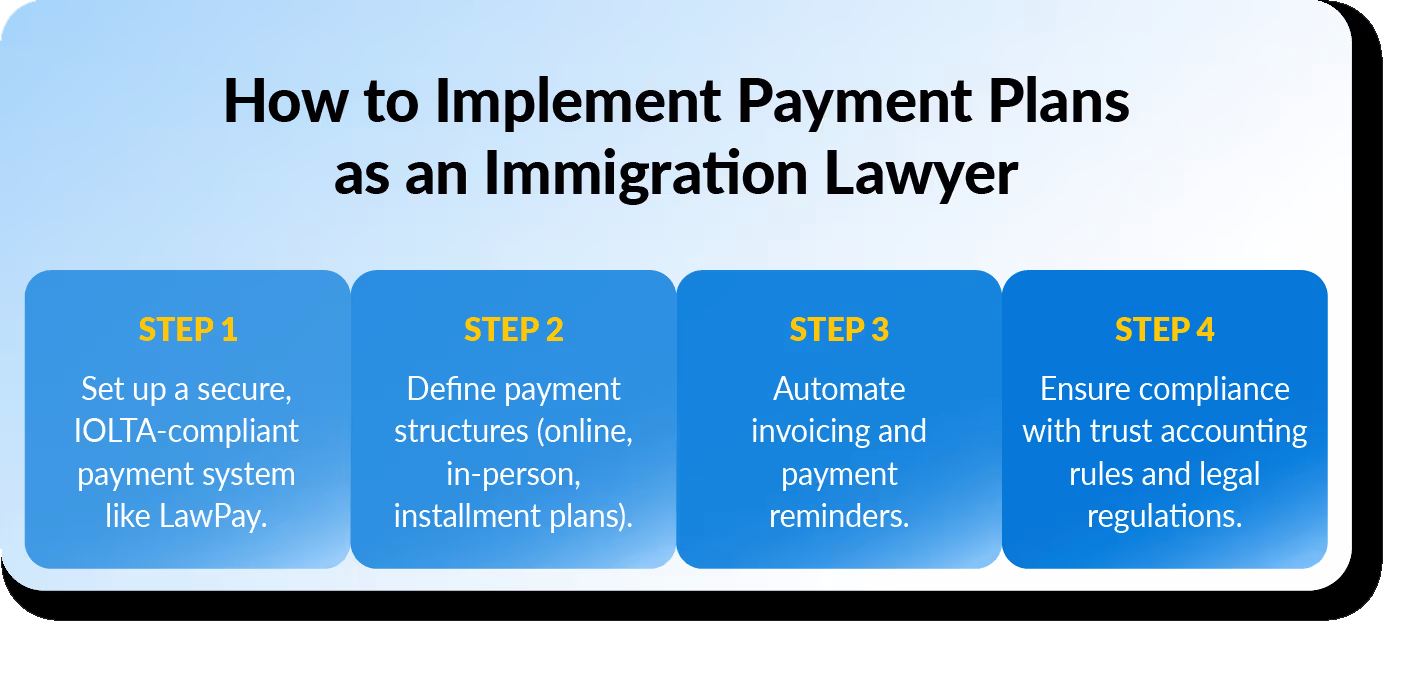

How to Implement Payment Plans as an Immigration Lawyer

While there are benefits to adopting payment plans, a structured process is also necessary to ensure that the offering provides value to the law firm and client. Below are four simple steps to building an effective payment plan strategy for lawyers.

Step 1: Set Up a Secure Online Payment Processing System

The first step is to implement a secure, IOLTA-compliant payment processing system. Online payments often involve trust account funds, so the payment platform must comply with legal regulations.

For example, LawPay, which integrates directly into Docketwise, is designed for law firms and trusted by over 115,000 legal professionals. It ensures that client funds are properly managed and separated. It also allows clients to pay securely online using credit cards or eChecks—providing flexibility and improving on-time payments.

Step 2: Define Payment Structures

After setting up a payment system, define the payment options you'll offer. Flexible payment structures increase the likelihood of timely payments and improve client satisfaction.

Consider offering:

Online payments:

Secure payments via credit card or eCheck

In-person payments:

For clients who prefer face-to-face transactions

Installment plans

: Breaks down fees into manageable payments over time

With Docketwise + LawPay, firms can customize payment plans to fit the complexity of each case and the client’s financial situation.

Step 3: Automate Invoicing and Payment Reminders

Automating the invoicing process helps firms improve efficiency and reduces the time spent on collections.

With legal billing software like Docketwise, firms can generate professional invoices automatically and send them directly to clients. Clients can view their invoices and payment history through a secure client portal, reducing the need for manual follow-ups.

You can also set up automated email reminders to notify clients about upcoming payments, reducing the need for manual follow-ups. When clients have clear visibility into their payment obligations and are reminded automatically, they are more likely to stay on track.

Step 4: Ensure Compliance and Financial Security

Handling client payments comes with significant responsibility—especially when it involves IOLTA accounts and trust accounting rules. Any payment platform used by immigration firms must follow legal industry regulations to protect client funds and ensure proper allocation of payments.

How Docketwise and LawPay Simplify Payments for Immigration Lawyers

The Docketwise and LawPay integration provides a complete payment solution for immigration law firms. Lawyers can set up automated payment plans, process online payments, and track billing—all within a single platform. Key benefits include:

Automated payment plans

: Create custom installment plans and schedule automated billing to reduce missed payments.

A seamless client experience

: Clients can securely submit payments online through a user-friendly portal.

Compliance and security

: LawPay ensures IOLTA-compliant payment processing, helping firms manage trust accounts properly.

Offering flexible payment plans helps immigration lawyers increase client satisfaction, improve cash flow, and reduce administrative work. With the Docketwise and LawPay integration, you can provide secure, convenient payment options for your clients.

Schedule a demo to see how Docketwise can transform your firm’s payment process.

Unlock Your Success as an Immigration Lawyer.

Download Now

About the author

M.E. Hammond